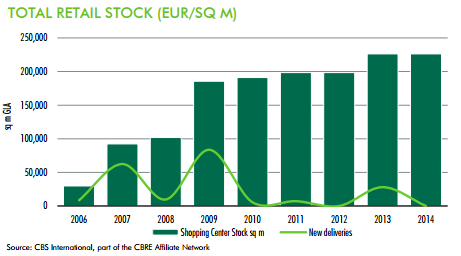

SHOPPING CENTER STOCK

During 2014, the total retail stock remained unchanged, standing at the level of of 230,000 sq m of GLA, i.e. 140 sq m per 1,000 inhabitants, including all types of retail schemes. Having substantial catchment area, Belgrade can support higher shopping centre provision rates. Belgrade remains relatively undersupplied market given the size of the economy and population, therefore representing the excellent opportunity for shopping center developments.

In terms of new deliveries, the retail market is experiencing the intensive development. The opening of Retail park Zemun holding 15,300 sq m of GBA in Zemun, is scheduled for Spring 2015. In addition, Israeli investor Aviv Arlon works actively on the development of the retail park in Zvezdara municipality which will comprise 11,000 sq m of GLA. Belgrade retail market also witnesses the construction of the project in Belgrade high street zone, in Rajiceva Street, at the foot of the main pedestrian zone, which, once completed, will hold 15,000 sq m of GLA.

Throughout Serbia, in 2014, the new openings have been limited to smaller-scale retail parks, which require lower initial capital, such as the 9,700 sq m Capitol Park in the city of Sabac and the 10,000 sq m Vivo shopping Park in Jagodina. After Pancevo and Belgrade municipality Zvezdara, Aviv Arlon selected Zrenjanin to develop the retail park of 32,000 sq m of GBA, where the preparatory works recently commenced. In addition, Austrian Immofinanz Group is planning to develop retail park schemes in Subotica and Cacak. Their Stop.Shop project in Cacak of 6,300 sq m is set for completion for April 2015, while the construction works on its project in Subotica of 7,300 sq m will commence after obtaining the construction permit. Subotica has been also attractive for local MPC company, that aims to construct the scheme of 11,000 sq m. In terms of the new offer, Zira shopping center hosted two market entrants, Goose and Sugarfree which both opened their stores in December

When it comes to the investments in the retail segment, 2014 recorded two acquisitions: the acquisition of shopping mall Plaza Kragujevac of 22,000 sq m GLA, being acquired by NEPI Investment Group for EUR 38,6 million and the acquisition of Belgium Mitiska REIM that has acquired 85% share in the retail park Sabac Capitol Park.

HIGH STREET RETAIL

With limited available space in the shopping schemes, high street retail segment continually keeps the important position among the retailers. The local shoe brand Shoestar continued the strong expansion, by opening its high street store in the city center at Terazije Square.

RETAIL WAREHOUSE

The local food chain Univerexport group recently took over two food chains Lurdy from Zrenjanin and Angropromet from Kikinda, aiming to further increase its network. After taking over Slovenian Mercator, Croatian Agrokor Group commenced the process of rebranding stores throughout Serbia. In terms of the future supply, German LIDL secured the land lots in several Serbian cities, such as Belgrade, Valjevo, Subotica, Novi Sad, Nis, Subotica and Smederevo, targeting to open several stores across the country simultaneously.

Source: CBRE International